Optimizing benefits for families

By the Numbers

Reduction in food insecurity among low-income families who received the Child Tax Credit

People used ChildTaxCredit.gov to find free tax filing services and receive expanded tax benefits

The Challenge

The American Rescue Plan, signed by President Biden in March 2021, created unprecedented tax relief for millions of families through expanded tax credits, both for families who file their taxes and also for those who typically don’t file their taxes. As the global COVID-19 pandemic upended finances for many parents, this expansion made many more families eligible for additional credits while also sending monthly, advance payments for the first time.

But families that didn’t earn enough income in 2020 to require a tax filing – the people who needed the tax credits the most – were largely unaware of the economic assistance or that they needed to submit a tax return to qualify.

The Solution

The U.S. Digital Service partnered with The Department of Treasury and the White House to build ChildTaxCredit.gov. The website launched in January 2022 to educate families about the expanded Earned Income Credit and Child Tax Credit and to encourage eligible families to file a tax return in order to receive the funds. Additionally, the website provides a free tool to find tax assistance.

Working alongside our agency partners, the USDS team interviewed local governments, advocacy groups, non-profits, and tax filers to understand how these credits affected people’s lives. We learned that misinformation and confusion kept some families from taking the necessary steps to receive the tax credits. We launched the site to address the many needs we heard from user research, including that the site should be accessible, easy-to-read, and provide resources to find free tax filing services.

As a result of user tests that included people with different levels of English proficiency and accessibility needs, the site is mobile-friendly, available in Spanish, and reads at an eighth-grade level. Its clarity and accessibility reduce the need for people to seek information via other overburdened channels, such as IRS hotlines.

The Impact

The 2021 Child Tax Credit helps all families succeed and will reach nearly 40 million families representing 65 million children. The U.S. Treasury estimates the families of 26 million children will now receive the full, expanded amount of this credit. Under previous rules, they would only receive a partial credit because their incomes were too low.

These expanded benefits reduced food insufficiency among low-income families by 25% and helped bring child poverty to record lows in 2021, including record low Black and Hispanic child poverty.

ChildTaxCredit.gov has helped close to 50,000 taxpayers file their taxes for free across a number of free services found in the lookup tool.

Press

More projects

-

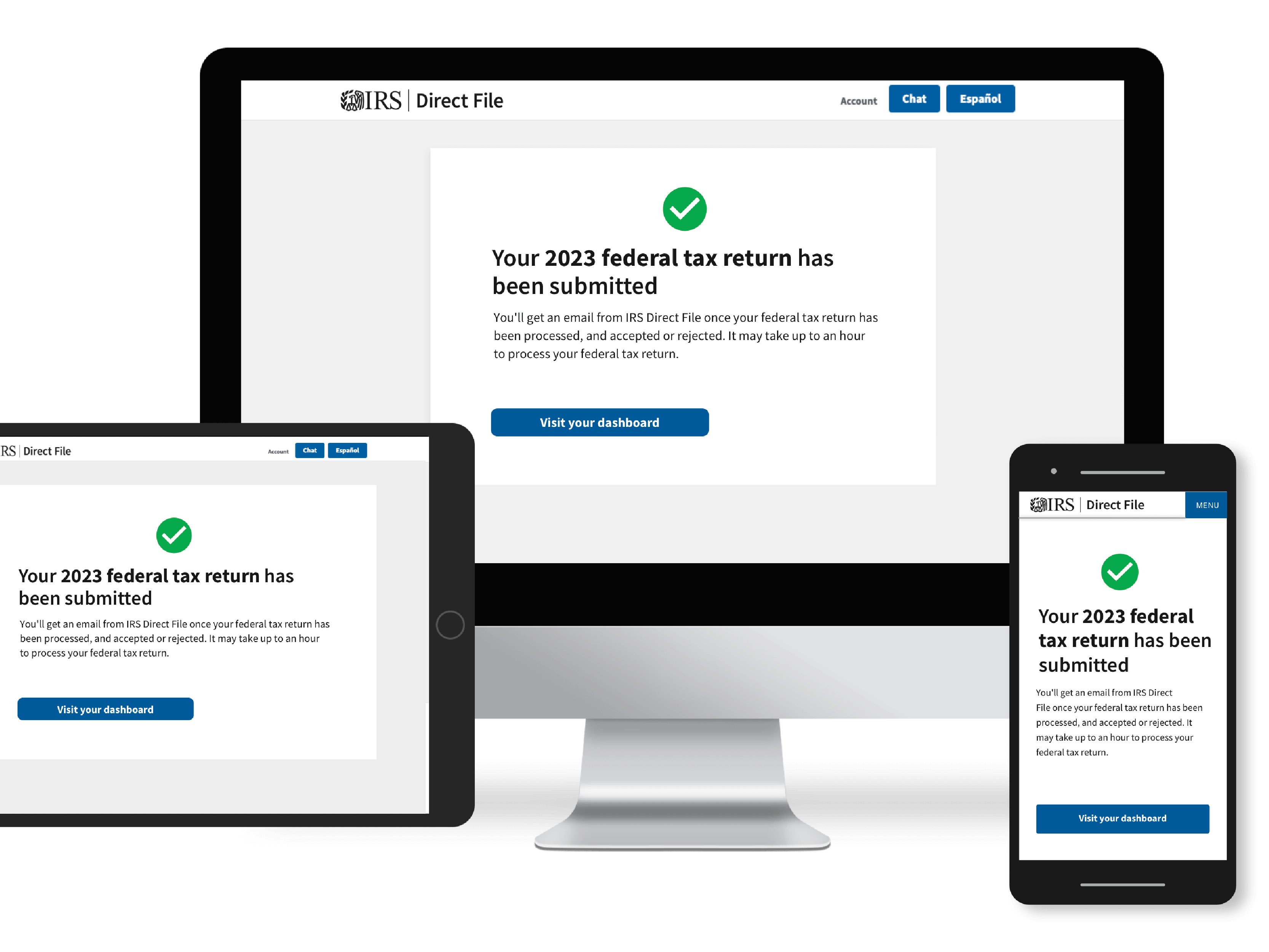

Internal Revenue Service

Internal Revenue ServiceFiling taxes for free with IRS’ Direct File

USDS partnered with the IRS to deliver the IRS Direct File Pilot, a free way for eligible people to file their taxes for free, directly with the IRS.

-

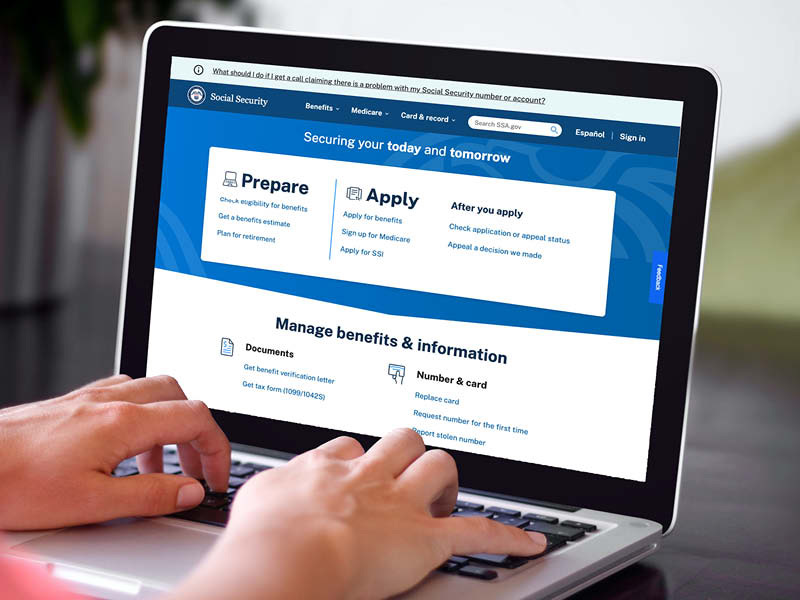

Social Security Administration

Social Security AdministrationContinuously improving SSA.gov

The Social Security Administration is building on the momentum from their partnership with the U.S. Digital Service by implementing iterative research, best practices, and a data-informed approach to ensure the website is usable and useful.

-

Centers for Disease Control and Prevention

Centers for Disease Control and PreventionPreparing for the next pandemic while building tech for COVID-19

We worked with the Centers for Disease Control and Prevention to quickly create and scale technology programs that digitize and share infectious disease test results in real-time.

-

Health and Human Services

Health and Human ServicesModernizing the child care application process

USDS partnered with ACF’s policy and subject matter experts to create a Model Child Care Assistance Application and eligibility verification practices that met federal guidelines and demonstrated the “art of what’s possible.

-

Cross-agency

Cross-agencyOptimizing benefits for families

Working alongside The Department of Treasury and the White House, we built ChildTaxCredit.gov to educate families about the expanded Earned Income Credit and Child Tax Credit. The USDS team relied on in-depth research to create a site that is accessible, easy-to-read, and provides resources to find free tax services.

-

Cross-agency

Cross-agencyChanging how the government hires technical talent

We helped develop a process that allows HR to leverage subject matter experts to evaluate candidates for specialized roles. The result restores fair and open access for all applicants, shortens the hiring timeline, and ensures applicants are truly qualified.

-

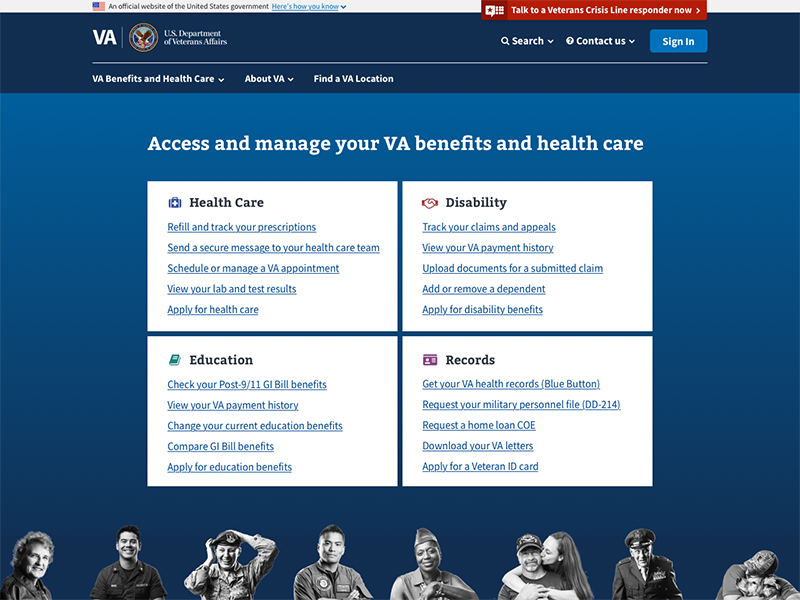

Veterans Affairs

Veterans AffairsSimplifying Veteran‑facing services through VA.gov

Each month, over 10 million people attempt to access the digital tools and content at the Department of Veterans Affairs (VA) and have historically struggled to find what they’re looking for. Digital modernization efforts needed to focus on improving the user experience.